What’s the Investability Score of your property? Free online tool launched.

Every property buyer or seller wants to make the most out of their investment. Booming house prices and mind-boggling mortgages make it even harder to be relaxed about this. So, a new and free online tool that assesses an area’s “investability” is a game-changer.

Residz Team 4 min read

Every property buyer or seller wants to make the most out of their investment. Booming house prices and mind-boggling mortgages make it even harder to be relaxed about this. So, a new and free online tool that assesses an area’s “investability” is a game-changer. In as little as 5 minutes, you'll know the investability score of your chosen neighbourhood, and can start negotiating from a place of power - not fear.

This blog post explains the free Residz.com investability scoring tool and what applications it can have for buyers, sellers, and real estate agents.

First up, what is Residz.com?

Residz.com is a free property research website that has mapped all 10 million dwellings in Australia, and overlaid dozens of pieces of data over each individual property.

Typing any address into the Residz.com search bar gives homeowners and prospective buyers never-before-seen information about their property. It includes school catchment areas, crime trends, live traffic information, development applications, and bushfire or flood risk. Properties that are for sale are clearly marked with links to the real estate agent’s website.

What is the new investability tool?

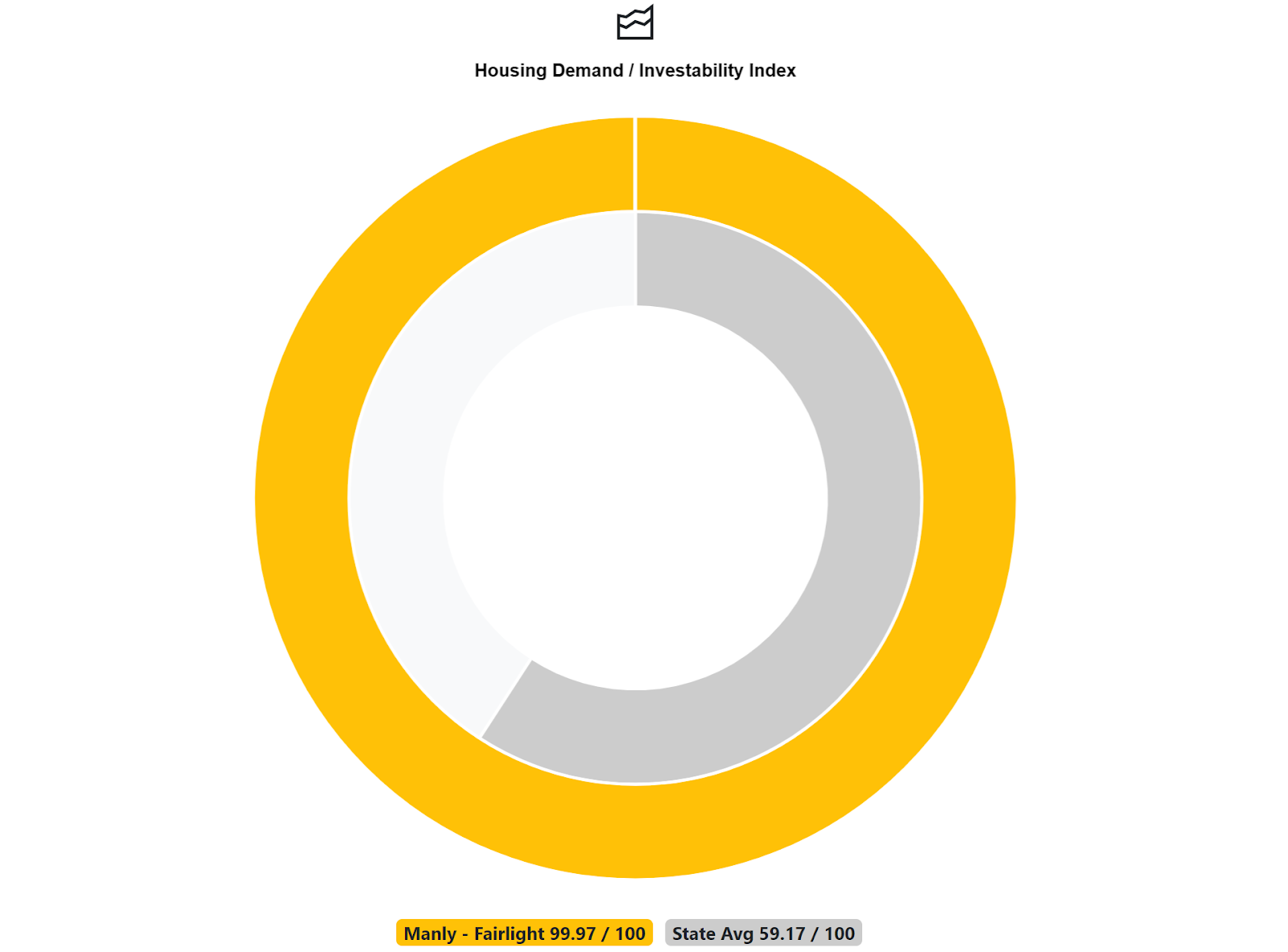

A new feature of Residz.com is the free housing demand/investability index. This helpful tool forecasts relative future housing demand of a specific region. In other words, it helps to determine which Australian properties could be good (or poor) investments.

The index is modelled on historical transactional and social area data analysis. It forecasts relative future housing demand across every suburb in a state by analysing variables historically associated with a level of propensity to pay for housing in various mortgage repayment and rent payment brackets. Some of the key variables are historical property prices, income levels, industry presence type, population density, development applications, and will shortly include future State and Federal infrastructure planning.

What size is the area being scored for investability?

Lockdown restrictions made many of us aware of the limits of our Local Government Area (LGA). Less known is that you also belong to a Statistical Area Level 2 region. According to the Australian Bureau of Statistics, this is designed to represent a community that interacts together “socially and economically” and varies in size from about 3,000 to 25,000 usual residents. There are 2,473 SA2 regions covering the whole of Australia without gaps or overlaps, like pieces in a jigsaw puzzle. Why am I telling you this? Because the Residz investability index forecasts relative future housing demand (in various mortgage repayment and rent payment brackets) across every SA2 region in a state. Some are better investments than others.

What variables are used in the investability index?

There are dozens of data points that crunch together to give an SA2 region a high or low investability index score.

The main variables analysed by the Residz data team when assessing housing demand include:

- House Price Score: Tracks past relative price performance according to prevailing supply and demand with extrapolation into the future based on current conditions.

- Income Score: The relationship between household and personal income statistics and the level of rent payments and mortgage repayments in an area is clear. Such local income demographics therefore are influential on type, size, and price of housing.

- Industry Score: The number and type of industry workforce predominance in an area impacts housing needs and pricing. The shift to working from home for example for office workers compared to labour-intensive industry requiring on-site attendance, will shape the local demand for housing.

- Population Distribution Score: The types of family structures and their distribution in a suburb has a large impact on size and style of housing. For inner-city living for example, there may be a larger proportion of young couples requiring low-maintenance unit accommodation rather than houses with larger outdoor areas.

- Occupation Score: Housing affordability shows a close correlation to income levels which of course are connected to occupation. In areas of higher professional roles compared to blue-collar workers, it is likely that house prices are higher on average. Again, the working from home trend may lead to broader spread of professional people to lower cost areas thereby leading to “gentrification” of those areas.

How can I use the investability index?

While not replacing appropriate professional advice, the index is a fascinating and helpful tool for those marketing a property or deciding whether to invest in an area. For instance, sellers and real estate agents can market the investment potential of a property, as well as its appeal as a residential home. Buyers can check investability scores when comparing homes for sale. A low investability score can help to ease FOMO concerns as it indicates buyer demand for the area has been low, no matter what the agent may tell you. On the other hand, a high score might offer some peace of mind when paying a premium for their property.